Photograph by: Karolina Garbowska/Pexels

A Guide to Pricing Strategy

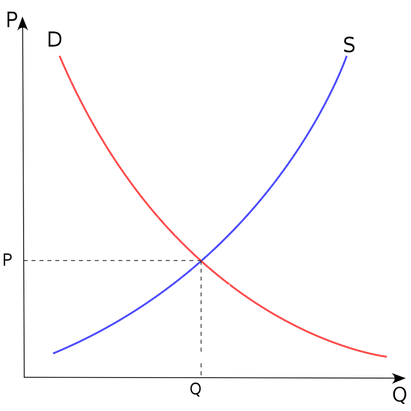

When setting prices, understanding what constitutes a price rather than relying on the standard food cost formula of: Price = Food Cost of Item / Ideal Food Cost Percentage is essential because it often does not adequately account for all of a business’ costs. To understand pricing it is important to start from an economic standpoint of supply and demand. That is, the ideal price of a good is at the intersection of the supply and demand curves. This means price is the maximum a consumer is willing to pay for the good (demand) while simultaneously being the minimum which the producer is willing to accept in order to stay in business (supply). To calculate price means that two factors need to be taken into account, the consumer’s perspective and the producer's perspective.

Consumer’s perspective (Demand Curve)

Understanding the consumer’s perspective is done through a market analysis. This will help determine the general pricing structure of a menu. In this analysis:

Build a comparison set also known as a Comp Set

In this analysis look at similar bars and restaurants to see what they are offering and at what price.

Perform a Strengths, Weaknesses, Opportunities and Threats analysis (SWOT) of each company in the comp set.

This will help identify if the comp set companies have an “accurate” pricing model from a consumer perspective.

Create a price point of the goods and services provided based upon the results of the two analyses.

Price ranges are more ideal than singular prices because some menu items may be more expensive to produce than other menu items, however they are typically all within the consumer’s tolerance of being similar in price.

Some general price ranges are:

$5-$7, $7-$10, $10-$12, $12-$15 or $15+

Build a comparison set also known as a Comp Set

In this analysis look at similar bars and restaurants to see what they are offering and at what price.

Perform a Strengths, Weaknesses, Opportunities and Threats analysis (SWOT) of each company in the comp set.

This will help identify if the comp set companies have an “accurate” pricing model from a consumer perspective.

- Strengths are internal, positive attributes of the company that are within the company's control.

- Weaknesses are negative factors that detract from the company's strengths. These are elements of the business which need to be improved on to make the firm competitive.

- Opportunities are external factors in the business environment that are likely to contribute to success.

- Threats are potential external factors of which the company cannot control their occurrence. Response strategies should be in place if the threat should occur.

- For more on pricing strategy visit hawaiibevguide.com/business-strategy

Create a price point of the goods and services provided based upon the results of the two analyses.

Price ranges are more ideal than singular prices because some menu items may be more expensive to produce than other menu items, however they are typically all within the consumer’s tolerance of being similar in price.

Some general price ranges are:

$5-$7, $7-$10, $10-$12, $12-$15 or $15+

Producer's Perspective (Supply Curve)

The general strategy behind the price of a menu item is to include fixed cost, variable cost and profits while keeping the price at-tractive to the consumer. That is:

Price = Fixed Cost + Variable Cost + Desired Profit

Price = Fixed Cost + Variable Cost + Desired Profit

-

1. Fixed Cost

-

2. Estimate Number of Units Sold

-

3. Calculate Variable Cost

-

4. Profit Margin

<

>

1. Calculate Fixed Costs

Fixed costs are the costs that do not change regardless of how many units are sold. A common error in many indus-tries is not adequately accounting for fixed costs, which leads to many business closure.

The fixed cost of a single sale is responsible for covering is dependent on the number of total units sold. For example:

Typically fixed costs include:

Labor as a fixed or variable cost item

Labor may be considered a fixed cost if the number of employees generally remains the same regardless of how busy the establishment is. Labor can also be a variable cost if more employees are added as sales increase. Your Dapper Consulting prefers calculating labor as a variable cost.

Allocating fixed cost to food versus beverage

Fixed costs are the costs that do not change regardless of how many units are sold. A common error in many indus-tries is not adequately accounting for fixed costs, which leads to many business closure.

The fixed cost of a single sale is responsible for covering is dependent on the number of total units sold. For example:

- If fixed costs are $10,000 and there are 1000 items sold at the same price, then each item will need to cover $10 worth of fixed costs ($10,000/1000)

- If fixed costs are $10,000 and there are 2000 items sold at the same price, then each item will need to cover $5 worth of fixed costs ($10,000/2000)

Typically fixed costs include:

- Rent, which is typically the largest line item.

- Utilities like electricity and internet can be considered fixed costs. Electricity is either covered in common area maintenance (CAM) or the additional energy draw for using the dishwasher and other variable usage appli-ances is minimal compared to the energy costs from always-on appliances like refrigeration, HVAC and lights.

- Insurance, license fees and other administrative costs.

- Reusable glassware, plates, utensils etc. are typically tied to the number of seats and not the number of dishes served therefore are fixed costs. However disposable elements like takeout cups are variable costs.

Labor as a fixed or variable cost item

Labor may be considered a fixed cost if the number of employees generally remains the same regardless of how busy the establishment is. Labor can also be a variable cost if more employees are added as sales increase. Your Dapper Consulting prefers calculating labor as a variable cost.

Allocating fixed cost to food versus beverage

- Restaurants can use the estimated percentage of revenue from the bar program versus the estimated percentage of revenue from the food program to allocate a percentage of the fixed cost to each menu item.

- For example: If 40% of revenue comes from beverage sales and 60% from the food sales, and fixed costs are $10,000, then 40% of fixed costs ($4000) can be allocated to costs the bar sales should cover and 60% ($6,000) are fixed costs food sales should cover.

2. Estimate the number of units sold per period (most likely per month)

- Estimating the number of units sold per month will be helpful in estimating the amount of fixed cost sale needs to cover.

- Using a monthly estimate is ideal because most of the large fixed costs like rent need to be paid monthly. It may also be helpful to estimate the daily and weekly costs.

- Calculating the number of units needed to be sold to cover fixed costs is a good starting point for estimating the number of units to be sold. For example: If fixed costs are $10,000 and each item is $7, then $10,000/$7 = 1429 items sold per month are needed to cover costs. If open for 5 days, then at least 286 units need to be sold per day.

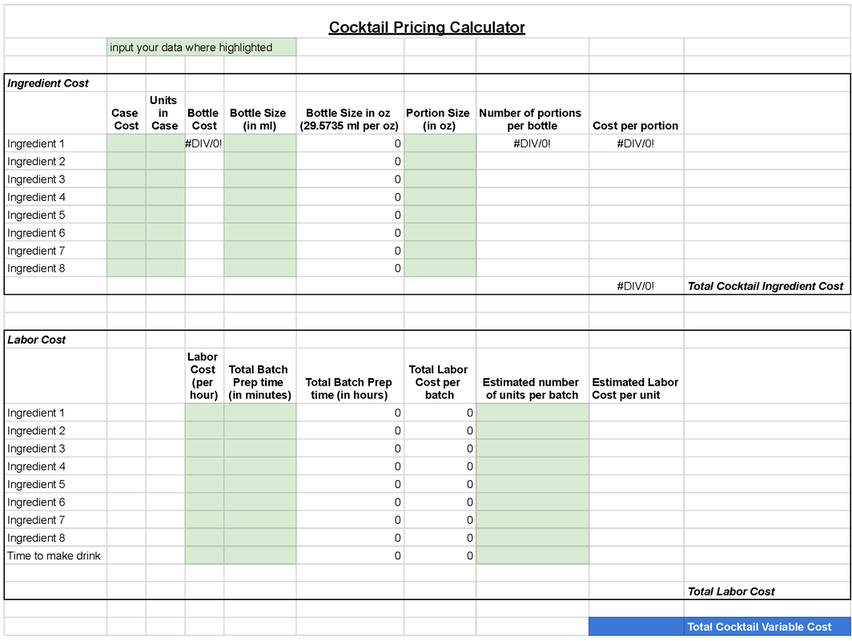

3. Calculate Variable Costs

Variable costs are the costs that increase for every additional unit sold.

Cost per unit of Ingredient A = (Total Ingredient cost/ quantity of ingredient used per unit sold) /price. Where:

Cost per portion is the variable cost of the ingredients.

To calculate the labor cost per unit:

Q Factor, represents the additional costs required for the service experience. These are variable costs including items like table side condiments and napkins. Q factor is typically more applicable to food service than beverage service.

Variable costs are the costs that increase for every additional unit sold.

- Ingredients are the major variable cost. To calculate the cost of ingredients including garnishes:

Cost per unit of Ingredient A = (Total Ingredient cost/ quantity of ingredient used per unit sold) /price. Where:

- Case Cost: Is the total cost of the case. This calculation can be skipped if individual bottles are being purchased.

- Units in Case: This is typically 6, 12, 24 or 36 depending on what is being purchased. This calculation can be skipped if individual bottles are being purchased.

- Bottle cost = Case Cost / Units in Case

- If the ingredient is a homemade syrup or infusion, this can be the total cost of the ingredients used to make one batch.

- If the ingredient is produce, herbs or spices, then the cost per unit can be used.

- Bottle Size in ml: This is typically 750ml or 1000ml.

- If the ingredient is a homemade syrup or infusion, this can be the total batch size in ml. If the batch size is in oz, then this can be skipped and that number can be input into bottle size instead.

- If the ingredient is produce, herbs or spices then this section should be skipped.

- Bottle size in oz = Bottle size in ml/29.5735 ml per oz.

This is a necessary conversion because most drink recipes are in oz- If the ingredient is a homemade syrup or infusion, this can be the total batch size in oz.

- If the ingredient is produce, herbs or spices then the quantity of herbs, spices or produce should be weighted and input here.

- Portion Size (in oz) is the quantity of spirit or mixer used per drink.

- If the ingredient is a homemade syrup or infusion, then the portion size in oz should be used.

- If the ingredient is produce, herbs or spices then the quantity in ounces used should be used.

- Number of portions per bottle

- If the ingredient is a homemade syrup or infusion, then this will be the number of portions per batch.

- If the ingredient is produce, herbs or spices then this quantity will be the number of portions per bunch.

Cost per portion is the variable cost of the ingredients.

To calculate the labor cost per unit:

- Labor Cost per hour: The hourly wage of the employee performing the task

- Total Prep time in minutes: Many tasks take minutes not hours.

- Total Prep time in hours = Total Prep time in minutes/ 60 minutes.

- Total Labor Cost = Labor Cost x Total Prep Time in hours

- Estimated labor Cost per Unit = Estimated labor cost /Estimated number of units sold

- Time to make the drink: The time it takes to make a drink should be accounted for not only because of labor costs, but it also factors into how many drinks can be made over the course of the bartender’s shift.

- On the spreadsheet some of the labor line items may have no value because a conversion from minutes to hours may not need to be made.

Q Factor, represents the additional costs required for the service experience. These are variable costs including items like table side condiments and napkins. Q factor is typically more applicable to food service than beverage service.

4. Profit

A percentage of the cost of a menu item will be profit. That is the return on investing money into all the fixed and variable costs. It is ideal to allocate a portion of the overall cost to profit. How much of the overall cost should be allocated to profit is personal preference. One approach is to have profit be in excess of 8-10% as that is the average return on investment in an S&P 500 Index fund that is passively managed (no buying or selling except for the initial purchase and the final sale).

A percentage of the cost of a menu item will be profit. That is the return on investing money into all the fixed and variable costs. It is ideal to allocate a portion of the overall cost to profit. How much of the overall cost should be allocated to profit is personal preference. One approach is to have profit be in excess of 8-10% as that is the average return on investment in an S&P 500 Index fund that is passively managed (no buying or selling except for the initial purchase and the final sale).

Variable Cost Calculator

An excel sheet which will calculate variable cost can be downloaded below:

| hawaii_bevearge_guide_cocktail_pricing_calculator.xlsx | |

| File Size: | 8 kb |

| File Type: | xlsx |

The Standard Food Cost Formula

When the Standard Food Cost Formula can be used

The standard food cost formula can be used when revenue and fixed costs (which in this case includes labor) are known and predictable. This situation allows for fixed costs to be calculated as a percentage of profit. To calculate price:

Price = Food Cost of Item / Food Cost Percentage

Where

Food Cost Percentage = 1 - [(Fixed Costs /Gross Revenue) + Profit]

*Food Cost Percentage is calculated to find the percentage of fixed costs/profit in relation to overall sales.

Example:

If: Gross Revenue = $10,000 Fixed Costs = $6,000

Desired profit = 15% = 0.15 Variable Cost = $2

Food Cost Percentage = 1 - [($6,000/$10,000) +.15] =

1 - [0.6+0.15] = 0.25

Food Cost / Food Cost Percentage = Price

$2 / 0.25 = $8.00

Accounting for Labor cost

This can be calculated into the price or at least should be a footnote if labor will be treated as a fixed cost. Labor cost should be taken into account because an item that takes 20 minutes to produce requires more paid labor than that which takes 5 minutes to produce (both including prep time), even if the ingredients cost is the same, therefore the 20 minute production time item should cost more, or at least be accounted for in some capacity. The messy approach to accounting for labor is what makes using this formula difficult.

The standard food cost formula can be used when revenue and fixed costs (which in this case includes labor) are known and predictable. This situation allows for fixed costs to be calculated as a percentage of profit. To calculate price:

Price = Food Cost of Item / Food Cost Percentage

Where

Food Cost Percentage = 1 - [(Fixed Costs /Gross Revenue) + Profit]

*Food Cost Percentage is calculated to find the percentage of fixed costs/profit in relation to overall sales.

Example:

If: Gross Revenue = $10,000 Fixed Costs = $6,000

Desired profit = 15% = 0.15 Variable Cost = $2

Food Cost Percentage = 1 - [($6,000/$10,000) +.15] =

1 - [0.6+0.15] = 0.25

Food Cost / Food Cost Percentage = Price

$2 / 0.25 = $8.00

Accounting for Labor cost

This can be calculated into the price or at least should be a footnote if labor will be treated as a fixed cost. Labor cost should be taken into account because an item that takes 20 minutes to produce requires more paid labor than that which takes 5 minutes to produce (both including prep time), even if the ingredients cost is the same, therefore the 20 minute production time item should cost more, or at least be accounted for in some capacity. The messy approach to accounting for labor is what makes using this formula difficult.