Photo's provided by The Curb/Kaimuki Selections

Natural and Low Intervention Wine from Kaimuki Selections, Kaimuki Storeroom, and The Curb

People

Devin Uehara-Tilton: Co-Owner, day-to-day Operations Manager

Ross Uehara-Tilton Co-Owner, full-time attorney, part time coffee shop dishwasher, and lugger of

wine cases from the airport.

The Business

Kaimukī Selections Wine wholesale and distribution company.

Kaimukī Storeroom

Wine retail shop

The Curb Kaimukī

Coffee shop by day, wine barby night.

Devin Uehara-Tilton: Co-Owner, day-to-day Operations Manager

Ross Uehara-Tilton Co-Owner, full-time attorney, part time coffee shop dishwasher, and lugger of

wine cases from the airport.

The Business

Kaimukī Selections Wine wholesale and distribution company.

Kaimukī Storeroom

Wine retail shop

The Curb Kaimukī

Coffee shop by day, wine barby night.

History

|

The Curb Kaimukī

The story of Kaimukī Distributors starts with Devin Uehara-Tilton’s foray into the coffee industry as a barista during college for The Curb under its prior ownership on the University of Hawaiʻi at Manoa’s campus. The Curb eventually moved into a brick and mortar location at U.H. Manoa’s Paradise Palms Café and Food Court, then expanded to other sites, including the on-campus Sinclair Library, and off-campus locations 143 Hekili St #120 in Kailua, which opened in 2016, and 3538 Waialae Ave #101. At the end of 2017, there was a chance that the company would have to shut down. As Ross explains it, “By then, all of the employees had become our really good friends, and customers had become like family. It would have been a shame to see that community disappear. And while it may have replicated itself somewhere else, with the same people and the same coffee, I think our longtime regulars would agree that our community is irreplaceable. It wouldn't be the same.” While it wasn’t easy, Devin and Ross were able to traverse the company’s revival by, amongst other things, becoming architects, designers, plumbers, electricians and construction managers to complete the build-out of a new Kaimukī location at 3408 Waialae Ave. “I never planned to be a coffee shop owner, and I don't know if Devin ever planned to be a barista for the rest of his life or even a coffee shop owner, but adversity breeds opportunity, and here we are today,” Ross said. Doors opened on January 13, 2018. “Our soft opening was the day of the false missile alert. We did a free bottled cold brew and a ‘come hang out and check out the new space’. |

Then we all got the alert on our phones at 8 o'clock in the morning and were literally sitting out on the curb, looking up at the sky for a missile that luckily never came, and contemplating what felt like our final

moments. . . I'm almost tearing up thinking about it. But going through that experience with those people is part of what makes us who we are today,” recanted Ross. The location was a success, but the owners quickly found its three tables and two bar seats were not enough. “From day one, the line was out the door. We very quickly outgrew that space,” Ross said. Though the COVID pandemic impacted the tourism portion of their business, the support of the local community led to the expansion of The Curb. Fortunately, the adjacent space, which Ross had an eye on, was made available by its landlord, Finance Factors, after two years of sitting vacant. Ross explained, “It was a Chinese restaurant, then Young Scale Company, and then an AT&T store which closed their doors before we even moved in next door. Our landlord, Finance Factors, who has an informal, unspoken connection between coffee shops in Hawaiʻi –their buildings have coffee shops like Morning Glass in Manoa and the former Brue Bar at the downtown location – gave us an opportunity. It wouldn't have been possible without our customers, and I’m happy and proud about the fact that during the pandemic we didn't have to ask for any kind of rent relief, and were able to pay full rent the whole time.” The doors opened in April 2021. Devin and Ross thought they would have ample space, but again, “From day one, it's felt like it's not been enough,” Ross said. |

The general strategy behind the price of a menu item is to include fixed cost, variable cost and profits while keeping the price at-tractive to the consumer. That is:

Price = Fixed Cost + Variable Cost + Desired Profit

Price = Fixed Cost + Variable Cost + Desired Profit

-

1. Fixed Cost

-

2. Estimate Number of Units Sold

-

3. Calculate Variable Cost

-

4. Profit Margin

<

>

1. Calculate Fixed Costs

Fixed costs are the costs that do not change regardless of how many units are sold. A common error in many indus-tries is not adequately accounting for fixed costs, which leads to many business closure.

The fixed cost of a single sale is responsible for covering is dependent on the number of total units sold. For example:

Typically fixed costs include:

Labor as a fixed or variable cost item

Labor may be considered a fixed cost if the number of employees generally remains the same regardless of how busy the establishment is. Labor can also be a variable cost if more employees are added as sales increase. Your Dapper Consulting prefers calculating labor as a variable cost.

Allocating fixed cost to food versus beverage

Fixed costs are the costs that do not change regardless of how many units are sold. A common error in many indus-tries is not adequately accounting for fixed costs, which leads to many business closure.

The fixed cost of a single sale is responsible for covering is dependent on the number of total units sold. For example:

- If fixed costs are $10,000 and there are 1000 items sold at the same price, then each item will need to cover $10 worth of fixed costs ($10,000/1000)

- If fixed costs are $10,000 and there are 2000 items sold at the same price, then each item will need to cover $5 worth of fixed costs ($10,000/2000)

Typically fixed costs include:

- Rent, which is typically the largest line item.

- Utilities like electricity and internet can be considered fixed costs. Electricity is either covered in common area maintenance (CAM) or the additional energy draw for using the dishwasher and other variable usage appli-ances is minimal compared to the energy costs from always-on appliances like refrigeration, HVAC and lights.

- Insurance, license fees and other administrative costs.

- Reusable glassware, plates, utensils etc. are typically tied to the number of seats and not the number of dishes served therefore are fixed costs. However disposable elements like takeout cups are variable costs.

Labor as a fixed or variable cost item

Labor may be considered a fixed cost if the number of employees generally remains the same regardless of how busy the establishment is. Labor can also be a variable cost if more employees are added as sales increase. Your Dapper Consulting prefers calculating labor as a variable cost.

Allocating fixed cost to food versus beverage

- Restaurants can use the estimated percentage of revenue from the bar program versus the estimated percentage of revenue from the food program to allocate a percentage of the fixed cost to each menu item.

- For example: If 40% of revenue comes from beverage sales and 60% from the food sales, and fixed costs are $10,000, then 40% of fixed costs ($4000) can be allocated to costs the bar sales should cover and 60% ($6,000) are fixed costs food sales should cover.

2. Estimate the number of units sold per period (most likely per month)

- Estimating the number of units sold per month will be helpful in estimating the amount of fixed cost sale needs to cover.

- Using a monthly estimate is ideal because most of the large fixed costs like rent need to be paid monthly. It may also be helpful to estimate the daily and weekly costs.

- Calculating the number of units needed to be sold to cover fixed costs is a good starting point for estimating the number of units to be sold. For example: If fixed costs are $10,000 and each item is $7, then $10,000/$7 = 1429 items sold per month are needed to cover costs. If open for 5 days, then at least 286 units need to be sold per day.

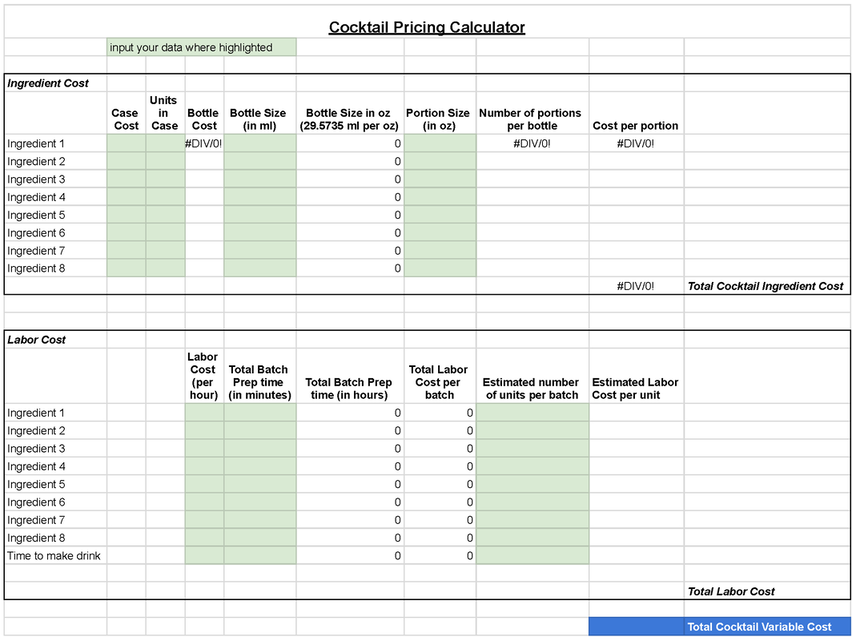

3. Calculate Variable Costs

Variable costs are the costs that increase for every additional unit sold.

Cost per unit of Ingredient A = (Total Ingredient cost/ quantity of ingredient used per unit sold) /price. Where:

Cost per portion is the variable cost of the ingredients.

To calculate the labor cost per unit:

Q Factor, represents the additional costs required for the service experience. These are variable costs including items like table side condiments and napkins. Q factor is typically more applicable to food service than beverage service.

Variable costs are the costs that increase for every additional unit sold.

- Ingredients are the major variable cost. To calculate the cost of ingredients including garnishes:

Cost per unit of Ingredient A = (Total Ingredient cost/ quantity of ingredient used per unit sold) /price. Where:

- Case Cost: Is the total cost of the case. This calculation can be skipped if individual bottles are being purchased.

- Units in Case: This is typically 6, 12, 24 or 36 depending on what is being purchased. This calculation can be skipped if individual bottles are being purchased.

- Bottle cost = Case Cost / Units in Case

- If the ingredient is a homemade syrup or infusion, this can be the total cost of the ingredients used to make one batch.

- If the ingredient is produce, herbs or spices, then the cost per unit can be used.

- Bottle Size in ml: This is typically 750ml or 1000ml.

- If the ingredient is a homemade syrup or infusion, this can be the total batch size in ml. If the batch size is in oz, then this can be skipped and that number can be input into bottle size instead.

- If the ingredient is produce, herbs or spices then this section should be skipped.

- Bottle size in oz = Bottle size in ml/29.5735 ml per oz.

This is a necessary conversion because most drink recipes are in oz- If the ingredient is a homemade syrup or infusion, this can be the total batch size in oz.

- If the ingredient is produce, herbs or spices then the quantity of herbs, spices or produce should be weighted and input here.

- Portion Size (in oz) is the quantity of spirit or mixer used per drink.

- If the ingredient is a homemade syrup or infusion, then the portion size in oz should be used.

- If the ingredient is produce, herbs or spices then the quantity in ounces used should be used.

- Number of portions per bottle

- If the ingredient is a homemade syrup or infusion, then this will be the number of portions per batch.

- If the ingredient is produce, herbs or spices then this quantity will be the number of portions per bunch.

Cost per portion is the variable cost of the ingredients.

To calculate the labor cost per unit:

- Labor Cost per hour: The hourly wage of the employee performing the task

- Total Prep time in minutes: Many tasks take minutes not hours.

- Total Prep time in hours = Total Prep time in minutes/ 60 minutes.

- Total Labor Cost = Labor Cost x Total Prep Time in hours

- Estimated labor Cost per Unit = Estimated labor cost /Estimated number of units sold

- Time to make the drink: The time it takes to make a drink should be accounted for not only because of labor costs, but it also factors into how many drinks can be made over the course of the bartender’s shift.

- On the spreadsheet some of the labor line items may have no value because a conversion from minutes to hours may not need to be made.

Q Factor, represents the additional costs required for the service experience. These are variable costs including items like table side condiments and napkins. Q factor is typically more applicable to food service than beverage service.

4. Profit

A percentage of the cost of a menu item will be profit. That is the return on investing money into all the fixed and variable costs. It is ideal to allocate a portion of the overall cost to profit. How much of the overall cost should be allocated to profit is personal preference. One approach is to have profit be in excess of 8-10% as that is the average return on investment in an S&P 500 Index fund that is passively managed (no buying or selling except for the initial purchase and the final sale).

A percentage of the cost of a menu item will be profit. That is the return on investing money into all the fixed and variable costs. It is ideal to allocate a portion of the overall cost to profit. How much of the overall cost should be allocated to profit is personal preference. One approach is to have profit be in excess of 8-10% as that is the average return on investment in an S&P 500 Index fund that is passively managed (no buying or selling except for the initial purchase and the final sale).

Variable Cost Calculator

An excel sheet which will calculate variable cost can be downloaded below:

| hawaii_bevearge_guide_cocktail_pricing_calculator.xlsx | |

| File Size: | 8 kb |

| File Type: | xlsx |

The Standard Food Cost Formula

When the Standard Food Cost Formula can be used

The standard food cost formula can be used when revenue and fixed costs (which in this case includes labor) are known and predictable. This situation allows for fixed costs to be calculated as a percentage of profit. To calculate price:

Price = Food Cost of Item / Food Cost Percentage

Where

Food Cost Percentage = 1 - [(Fixed Costs /Gross Revenue) + Profit]

*Food Cost Percentage is calculated to find the percentage of fixed costs/profit in relation to overall sales.

Example:

If: Gross Revenue = $10,000 Fixed Costs = $6,000

Desired profit = 15% = 0.15 Variable Cost = $2

Food Cost Percentage = 1 - [($6,000/$10,000) +.15] =

1 - [0.6+0.15] = 0.25

Food Cost / Food Cost Percentage = Price

$2 / 0.25 = $8.00

Accounting for Labor cost

This can be calculated into the price or at least should be a footnote if labor will be treated as a fixed cost. Labor cost should be taken into account because an item that takes 20 minutes to produce requires more paid labor than that which takes 5 minutes to produce (both including prep time), even if the ingredients cost is the same, therefore the 20 minute production time item should cost more, or at least be accounted for in some capacity. The messy approach to accounting for labor is what makes using this formula difficult.

The standard food cost formula can be used when revenue and fixed costs (which in this case includes labor) are known and predictable. This situation allows for fixed costs to be calculated as a percentage of profit. To calculate price:

Price = Food Cost of Item / Food Cost Percentage

Where

Food Cost Percentage = 1 - [(Fixed Costs /Gross Revenue) + Profit]

*Food Cost Percentage is calculated to find the percentage of fixed costs/profit in relation to overall sales.

Example:

If: Gross Revenue = $10,000 Fixed Costs = $6,000

Desired profit = 15% = 0.15 Variable Cost = $2

Food Cost Percentage = 1 - [($6,000/$10,000) +.15] =

1 - [0.6+0.15] = 0.25

Food Cost / Food Cost Percentage = Price

$2 / 0.25 = $8.00

Accounting for Labor cost

This can be calculated into the price or at least should be a footnote if labor will be treated as a fixed cost. Labor cost should be taken into account because an item that takes 20 minutes to produce requires more paid labor than that which takes 5 minutes to produce (both including prep time), even if the ingredients cost is the same, therefore the 20 minute production time item should cost more, or at least be accounted for in some capacity. The messy approach to accounting for labor is what makes using this formula difficult.

RSS Feed

RSS Feed